| | Listed below are the names, ages as of March 24, 2016, and the directors who are elected at the 2014 Annual General Meeting under Proposal No. 2, whose terms will expire in 2017, will continue to hold office until the end of the terms for which they were recently elected. Therefore, if the Amendment is approved all directors will be elected on an annual basis beginning with the 2017 Annual General Meeting. The shaded blocks in the table below illustrates the years in which members of our Board would stand for annual elections if the proposal is approved by our shareholders. | | | | | | | | | | Election Year | | Director | | 2015 | | 2016 | | 2017 | Flanagan, Henrikson, Johnson | | | | | | | Canion, Wood | | | | | | | Kessler, Wagoner | | | | | | |

In all cases, each director will hold office until his or her successor has been elected and qualified or until the director’s earlier resignation or removal. If the Amendment is not approved, the Board of Directors will remain classified. Appendix A shows the proposed changes to Bye-Laws 8, 11 and 12, with deletions indicated by strikeouts and additions indicated by underlining.

Recommendation of the Board

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE AMENDMENT TO THE BYE-LAWS. This proposal requires the affirmative vote of at least 75% of the issued and outstanding shares of the company. Abstentions will have the same effect as votes “against” the proposal.

Proposal No. 2

Election of Directors

The Board is divided into three classes, and our Class I directors are serving a term of office expiring at the 2014 Annual General Meeting. A director holds office until the annual general meeting of shareholders for the year in which his or her term expires, and until such director’s successor has been duly elected and qualified or until such director is removed from office under our Bye-Laws or such director’s office is otherwise earlier vacated. At each annual general meeting, successors to the class of directors whose term expires at such annual general meeting will be elected for a three-year term. However, if shareholders approve Proposal No. 1 providing for annual election of directors, beginning with the 2015 Annual General Meeting, successors to the class of directors whose term expires at such annual general meeting will be elected for a one-year term.

As previously announced, neither Mr. Rex Adams nor Sir John Banham has been nominated for re-election at the 2014 Annual General Meeting because each has reached the mandatory retirement age. Following the completion of the terms of Mr. Adams and Sir John Banham at the conclusion of the 2014 Annual General Meeting, the Board intends to reduce its size to nine (9) members.

The Board has nominated Messrs. Denis Kessler and G. Richard Wagoner, Jr. for election as directors of the company for a term ending at the 2017 Annual General Meeting. Messrs. Kessler and Wagoner are current directors of the company and further information regarding each of them is shown on the following page. Each nominee has indicated to the company that he would serve if elected. We do not anticipate that Messrs. Kessler or Wagoner would be unable to stand for election, but if that were to happen, the Board may reduce the size of the Board, designate a substitute or leave a vacancy unfilled. If a substitute is designated, proxies voting on the original director candidate will be cast for the substituted candidate.

Under our Bye-Laws, at any general meeting held for the purpose of electing directors at which a quorum is present, each director nominee receiving a majority of the votes cast at the meeting will be elected as a director. If a nominee for director who is an incumbent director is not elected and no successor has been elected at the meeting, the director is required under our Bye-Laws to submit his or her resignation as a director. Our Nomination and Corporate Governance Committee would then make a recommendation to the full Board on whether to accept or reject the resignation. If the resignation is not accepted by the Board, the director will continue to serve until the next annual general meeting and until his or her successor is duly elected, or his or her earlier resignation or removal. If the director’s resignation is accepted by the Board, then the Board may fill the vacancy. However, if the number of nominees exceeds the number of positions available for the election of directors, the directors so elected shall be those nominees who have received the greatest number of votes and at least a majority of the votes cast in person or by proxy.

Recommendation of the Board

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION TO THE BOARD OF EACH OF THE DIRECTOR NOMINEES. This proposal requires the affirmative vote of a majority of votes cast at the Annual General Meeting.

Information about Director Nominees

and Directors Continuing in Office

Director Nominees

Listed below are the names, ages as of March 31, 2014, and principal occupations for the past five years of the director nominees and directors continuing in office.

| | Director nominees for 2016 |

Non-ExecutiveJoseph R. Canion

Non-Executive Director Age 71 Director since 2002 Committees:

Audit,

Compensation,

Nomination and

Corporate

Governance

1997 | | Denis Kessler (62)Joseph R. Canion

Joseph Canion has served as a non-executive director of our company since March 2002.1997 and was a director of a predecessor constituent company (AIM Investments) from 1993 to 1997, when Invesco acquired that entity. Mr. Kessler is chairmanCanion co-founded Compaq Computer Corporation in 1982 and served as its chief executive officer from 1982 to 1991. He also founded Insource Technology Group in 1992 and served as its chairman until September 2006, and was a director of SCOR SE,ChaCha Search, Inc. from 2007 until August 2015. Mr. Canion received a B.S. and he also serves as a memberM.S. in electrical engineering from the University of Houston. He is on the board of directors of BNP Paribas SA. Mr. Kessler previously served on the boards of directors of Bollore from 1999 until 2013, Fonds Strategique d’Investissement from 2008 until 2013 and Dassault Aviation from 2003 until 2014. He is member of the supervisory board of Yam Invest N.V., a privately-held company, and a global counsellor of The Conference Board. Prior to joining the SCOR group, Mr. Kessler was chairman of the French Insurance Federation, senior executive vice president of the AXA Group and executive vice chairman of the French Business Confederation. Mr. Kessler is a graduate of École des Hautes Études Commerciales (HEC Paris). He holds a Doctorat d’Etat of the University of Paris. He is a Doctor Honoris Causa from the Moscow Academy of Finance and the University of Montreal.Houston Methodist Research Institute. SkillsBoard committees

Nomination and ExpertiseCorporate Governance (chairperson) | | Denis Kessler’sDirector qualifications:

|

| | | | n | | Former public company CEO, global business experience: Mr. Canion has notable experience as an economist and chief executive ofentrepreneur, having co-founded a business that grew into a major global reinsuranceinternational technology company. We believe that his experience guiding a company have combined to givethroughout its business lifecycle has given him valuable insight into botha wide-ranging understanding of the types of issues faced by public companies. | | n | | Relevant industry experience: Mr. Canion has extensive service as a board member within the investment management industry’s macro-economic positioning over the long term as well as our company’s particular challenges within that industry. Further, his experienceindustry, having also served as a director of AIM Investments, a variety of international public companies in several industries has enabled him to provide effective counsel to our Board on many issues of concern to our management.leading U.S. mutual fund manager, from 1993 through 1997 when Invesco acquired AIM. |

Non-Executive

Director

Director since 2013

Committees:

Audit,

Compensation,

Nomination and

Corporate

Governance

n | | G. Richard (“Rick”) Wagoner, Jr. (61)Information technology industry experience: Mr. Canion has served as a non-executive director of our company since October 2013. Mr. Wagoner served as chairman and chief executive officer of General Motors Corporation (“GM”) from May 2003 through March 2009, and had been president and chief executive officer since June 2000. Prior positions held at GM during his 32-year career with that company include executive vice president and president of North American operations, executive vice president, chief financial officer and head of worldwide purchasing, and president and managing director of General Motors do Brasil. On June 1, 2009, GM and its affiliates filed voluntary petitionsinvolved in the United States Bankruptcy Court for the Southern District of New York, seeking relief under Chapter 11 of the U.S. Bankruptcy Code. Mr. Wagoner was not an executive officer or director of GM at the time of that filing. Mr. Wagoner is a member of the board of directors of Graham Holdings Companytechnology industry since co-founding Compaq Computer Corporation and several privately-held companies. In addition, he is a member of the advisory boards of AEA Investors and Jefferies Investment Banking and Capital Markets Group, and he advises a number of start-up and early-stage ventures. Mr. Wagoner is a member of the board of visitors of Virginia Commonwealth University, chair of the Duke Kunshan University Advisory Board and a member of Duke’s Fuqua School of Business Advisory Board. He is a member of the mayor of Shanghai, China’s International Business Leaders Advisory Council. Mr. Wagoner received his B.A. from Duke University and his M.B.A. from Harvard University.

Skills and Expertise

Rick Wagoner brings to the Board valuable business, leadership and management insights into driving strategic direction and international operations gained from his32-year career with GM. Mr. Wagoner also brings significant experience in public company financial reporting and corporate governance matters gained through his service with other public companies.

founding Insource Technology Group. |

Directors Continuing in Office – Term Expiring in 2015

| | |

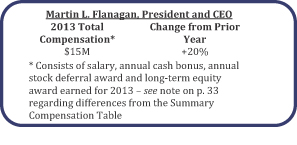

Martin L. Flanagan Director, President and

Chief Executive Officer Age 55 Director since 2005 | | Martin L. Flanagan, (53)CFA & CPA Martin Flanagan has been a director and President and Chief Executive Officer of Invesco since August 2005. He is also a trustee and vice-chairmanvice-chairperson of the Invesco Family of Funds.Funds (the company’s U.S. open- and closed-end fund companies). Mr. Flanagan joined Invesco from Franklin Resources, Inc., where he was president and co-chief executive officer from January 2004 to July 2005. Previously he had been Franklin’s co-president from May 2003 to January 2004, chief operating officer and chief financial officer from November 1999 to May 2003, and senior vice president and chief financial officer from 1993 until November 1999. Mr. Flanagan served as director, executive vice president and chief operating officer of Templeton, Galbraith & Hansberger, Ltd. before its acquisition by Franklin in 1992. Before joining Templeton in 1983, he worked with Arthur Andersen & Co. Mr. Flanagan receivedearned a B.A. and BBAB.B.A from Southern Methodist University (SMU). He is a CFA charterholder and a certified public accountant. He serves on the Board of Governors and as a member of the Executive Committee for the Investment Company Institute, and is a former chairman.chairperson. He also serves as a member of the executive board at the SMU Cox School of Business and is involved in a membernumber of various civic organizationsactivities in Atlanta. | | | Skills and ExpertiseDirector qualifications:

|

| | | | n | | MartinPublic company CEO, relevant industry experience: Mr. Flanagan has spent nearlyover 30 years in the investment management industry, including roles as an investment professional and a series of executive management positions in business integration, strategic planning, investment operations, shareholder services and finance, with over eighteleven years spent as a CEO. Mr. Flanagan also obtained extensive financial accounting experience with a major international accounting firm. He also is a Chartered Financial Analyst.chief executive officer. Through his decades of involvement, including as past chairmanformer chairperson of our industry’s principal trade association, the Investment Company Institute, he has amassed a broad understanding of the larger context of investment management that has guided the Board during many critical junctures.management.

| n | | Financial and accounting expertise: Mr. Flanagan obtained extensive financial accounting experience with a major international accounting firm and serving as chief financial officer of Franklin Resources. He is a chartered financial analyst and certified public accountant. |

| | |

Non-ExecutiveC. Robert Henrikson

Non-Executive Director Age 68 Director since 2012 Committees:

Audit,

Compensation,

and Nomination

and Corporate

Governance

| | C. Robert Henrikson (66) Robert Henrikson has served as a non-executive director of our company since January 2012. Mr. Henrikson was president and chief executive officer of MetLife, Inc. and Metropolitan Life Insurance Company from March 2006 through May 2011, and he served as a director of MetLife, Inc. from April 2005, and as chairman from April 2006 through December 31, 2011. During his more than 39-year career with MetLife, Inc., Mr. Henrikson held a number of senior positions in that company’s individual, group and pension businesses. Mr. Henrikson is a former chairman of the American Council of Life Insurers, a former chairman of the Financial Services Forum, a director emeritus of the American Benefits Council and a former member of the President’s Export Council. In 2012, Mr. Henrikson was elected to the board of directors of Swiss Re, where he serves as chairman of the compensation committee and is a member of the chairman’s and governance committee and the finance and risk committee. Mr. Henrikson also serves as chairman of the board of the S.S. Huebner Foundation for Insurance Education, as a member of the boards of trustees of Emory University and Indian Springs School and a member of the boardsboard of directors of The New York Philharmonic and Americares. Mr. Henrikson earned a bachelor’s degree from the University of Pennsylvania and a lawJ.D. degree from Emory University School of Law. In addition, he is a graduate of the Wharton School’s Advanced Management Program. SkillsBoard committees

Audit, Compensation (chairperson) and ExpertiseNomination and Corporate Governance | | | RobertDirector qualifications

|

| | | | n | | Former public company CEO, relevant industry experience: Mr. Henrikson’s nearly 40more than 39 years of experience in the financial services industry, which includes diverse positions of increasing responsibility leading to his role as chief executive officer of MetLife, Inc., have provided him with an in-depth understanding of our industry. | | n | | Public company board experience: Mr. Henrikson currently serves on the Board of Directors of Swiss Re (chairman of the compensation committee, member of the chairman’s and governance committee and the finance and risk committee). Until 2011, Mr. Henrikson served as the chairperson of the board of MetLife, Inc. |

| | |

Non-ExecutiveBen F. Johnson III

Chairperson and Non-Executive Director Age 72 Director since 2009 Committees:

Audit,

Compensation,

and Nomination

and Corporate

Governance

| | Ben F. Johnson (70)III Ben Johnson has served as Chairperson of our company since May 2014 and as a non-executive director of our company since January 2009. Mr. Johnson served as the managing partner at Alston & Bird LLP from 1997 to 2008. He was named a partner at Alston & Bird in 1976, having joined the firm in 1971. He receivedearned his B.A. degree from Emory University and his J.D. degree from Harvard Law School. He serves as chair of the board of trustees of Atlanta’s Woodward Academy and is the immediate past chair of the board of trustees of Emory University, a position he held from 2000-2013. Mr. Johnson also serves as a trustee of The Carter Center and the Charles Loridans Foundation. He is chair and a non-executive director of Summit Industries, Inc. SkillsBoard committees

Audit, Compensation and ExpertiseNomination and Corporate Governance Ben

Director qualifications: |

| | | | n | | Executive leadership, corporate governance, legal expertise: Mr. Johnson brings to the Board more than a decade of experience leading one of the largest law firms in Atlanta, Georgia, where Invesco was founded and grew to prominence. His more than 30-year career as one of the region’s leading business litigators has given Mr. Johnson deep experience of the types of business and legal issues that are regularly faced by large public companies such as Invesco. |

Non-Executive

Director

Director since 2005

Committees:

Audit, and

Nomination and

Corporate

Governance

n | | Thomas Presby (74) hasCivic and private company board leadership: Mr. Johnson serves on the Executive Committee of the Atlanta Symphony Orchestra and as a Trustee of The Carter Center and the Charles Loridans Foundation. Mr. Johnson is Chair Emeritus of Atlanta’s Woodward Academy, having served as Chair from 1983 to 2015, and is the immediate past chair of the board of trustees of Emory University, having served as Chair from 2000-2013. He is also Chair and a non-executive director of our company since November 2005 and as chairman of the Audit Committee since April 2006. OverSummit Industries, Inc., a period of thirty years as a partner at Deloitte LLP, he held many positions in the U.S. and abroad, including global deputy chairman and chief operating officer. Currently he is a director of the following other public companies where he also chairs the audit committees: First Solar, Inc., World Fuel Services Corp. and ExamWorks Group Inc. From 2003 to 2009, Mr. Presby was a director of Turbochef Technologies, Inc., from 2005 to 2011 he was a director of American Eagle Outfitters, Inc., and from 2003 to 2012 he was a director of Tiffany & Co. He is a board member of the New York chapter of the National Association of Corporate Directors and a trustee of Montclair State University (N.J.). He previously served as a trustee of Rutgers University and as a director and chairman of the audit committee of The German Marshall Fund of the USA. He received a B.S. in electrical engineering from Rutgers University and an MBA degree from the Carnegie Mellon University Graduate School of Business. Mr. Presby is a certified public accountant in New York and Ohio and a holder of the NACD Certificate of Director Education. He was named by the National Association of Corporate Directors as one of the “Top 100” directors of 2011.

Skills and Expertise

Thomas Presby has amassed considerable experience at the highest levels of finance and accounting, having served for three decades as a partner, as well as in positions of senior management (including chief operating officer), at one of the world’s largest accounting firms. In keeping with his experience, Mr. Presby has been sought by leading companies in a variety of industries to chair the audit committee, a role which he also fulfills for Invesco, where he is additionally recognized by the Board as one of our audit committee financial experts as defined under rules of the Securities and Exchange Commission.

privately-held company. |

| | |

Directors Continuing in Office – Term Expiring in 2016Edward P. Lawrence

|

Non-ExecutiveAge 74

Director

Director since 1997

Committees:

Nomination and

Corporate

Governance

| | Joseph Canion (69) has served as a non-executive director of our company since 1997 and was a director of a predecessor constituent company (AIM Investments) from 1993 to 1997, when Invesco acquired that entity. Mr. Canion has been a leading figure in the technology industry after co-founding Compaq Computer Corporation in 1982 and serving as its chief executive officer from 1982 to 1991. He also founded Insource Technology Group in 1992 and served as its chairman until September 2006. Mr. Canion received a B.S. and M.S. in electrical engineering from the University of Houston. He is on the board of directors of ChaCha Search, Inc. and is an advisory director of Encore Health Resources and Dynamics, Inc. and Houston Methodist Research Institute. From 2008 to 2011 he was a member of the board of Auditude.

Skills and Expertise

Joseph Canion has extensive service as a board member within the investment management industry, having also served as a director of AIM Investments, a leading U.S. mutual fund manager, from 1991 through 1997 when Invesco acquired AIM. Mr. Canion additionally has notable experience as an entrepreneur, havingco-founded a business that grew into a major international technology company. We believe that his experience guiding a company throughout the entirety of its business lifecycle has given him a wide-ranging understanding of the types of issues faced by private and public companies.

|

Non-Executive

Director

Director since 2004 Committees:

Audit

Compensation

and Nomination

and Corporate

Governance

| | Edward P. Lawrence (72) Edward Lawrence has served as a non-executive director of our company since October 2004. He was a partner of Ropes & Gray, a Boston law firm, from 1976 to Decemberthrough 2007. He currently is a retired partner of Ropes & Gray and a member of the investment committee of the firm’s trust department. Mr. Lawrence is a graduate of Harvard College and earned a J.D. degree from Columbia University Law School. He is chairman of Partners Health Care System, Inc. and chairman of Dana-Farber Partners Cancer Center. From 1995 to 2011 he was a trustee (and chairman from 1999 to 2008) of the Board of the Massachusetts General Hospital and was a trustee of McLean Hospital in Belmont, Massachusetts from 2000 to 2011. SkillsBoard committees

Audit, Compensation and ExpertiseNomination and Corporate Governance | | | EdwardDirector qualifications:

|

| | | | n | | Legal and regulatory expertise: Mr. Lawrence has over thirty years’years of experience as a corporate and business lawyer in a major Boston law firm, which has given him a very substantial understanding of the business issues facing large financial services companies such as Invesco. In particular, Mr. Lawrence specialized in issues arising under the Investment Company Act of 1940 and the Investment Advisers Act of 1940, which provide the Federal legal framework for the company’s U.S. investment management business. This background gives Mr. Lawrence an understanding of the potential legal ramifications of Board decisions, which is particularly valuable to the Board’s functioning on many of the decisions it is called upon to take. | | n | | Relevant industry experience: As a member of his law firm’s trust investment company practice and as member of investment committees of numerous entities, heMr. Lawrence also has had frequent interaction with investment advisers located throughout the country, giving him an opportunity to view a wide range of investment styles and practices. |

| | |

Sir Nigel Sheinwald Non-Executive Director Age 62 Director since 2015 | | Sir Nigel Sheinwald Sir Nigel Sheinwald has served as a non-executive director of our company since May 2015. Sir Nigel was a senior British diplomat who served as British Ambassador to the United States from 2007 to 2012, before retiring from Her Majesty’s Diplomatic Service. Prior to this, he served as Foreign Policy and Defence Adviser to the Prime Minister from 2003 to 2007. He served as British Ambassador and Permanent Representative to the European Union in Brussels from 2000 to 2003. Sir Nigel joined the Diplomatic Service in 1976 and served in Brussels, Washington, Moscow, and in a wide range of policy roles in London. From 2014 to 2015, Sir Nigel served as the Prime Minister’s Special Envoy on intelligence and law enforcement data sharing, to lead the effort to improve access to and sharing of law enforcement and intelligence data across international jurisdictions. Sir Nigel also serves as a senior advisor to the Universal Music Group, a non-executive director of the Innovia Group and a visiting professor and member of the Council at King’s College, London. In addition, Sir Nigel is a member of the U.S.-U.K. Fulbright Commission and serves on the Advisory Boards of the Ditchley Foundation, BritishAmerican Business, Business for New Europe and the Centre for European Reform. He is an Honorary Bencher of the Middle Temple, one of London’s legal inns of court. Sir Nigel received his M.A. degree from Balliol College, University of Oxford, where he is now an Honorary Fellow. Board committees Audit, Compensation and Nomination and Corporate Governance | | | Director qualifications: |

| | | | n | | Global and governmental experience, executive leadership: Sir Nigel brings unique global and governmental perspectives to the Board’s deliberations through his more than 35 years of service in Her Majesty’s Diplomatic Service. His extensive experience leading key international negotiations and policy initiatives, advising senior members of government and working closely with international businesses positions him well to counsel our Board and senior management on a wide range of issues facing Invesco. In particular, Sir Nigel’s experience in the British Government is an invaluable resource for advising the Board with respect to the many challenges and opportunities relating to regulatory affairs and government relations. | | n | | Public company board experience: Sir Nigel currently serves on the Board of Directors of Royal Dutch Shell plc (member of the Corporate and Social Responsibility Committee). |

| | |

Non-ExecutivePhoebe A. Wood

Non-Executive Director Age 62 Director since 2010 Committees:

Audit,

Compensation,

and Nomination

and Corporate

Governance

| | Phoebe A. Wood (60) Phoebe Wood has served as a non-executive director of our company since January 2010. She is currently a principal at CompaniesWood and served as vice chairman, chief financial officer and in other capacities at Brown-Forman Corporation from 2001 until her retirement in 2008. Prior to Brown-Forman, Ms. Wood was vice president, chief financial officer and a director of Propel Corporation (a subsidiary of Motorola) from 2000 to 2001. Previously, Ms. Wood served in various capacities during her tenure at Atlantic Richfield Company (ARCO) from 1976 to 2000. Ms. Wood currently serves on the boards of directors of Leggett & Platt, Incorporated (compensation committee), Coca-Cola Enterprises Inc. (audit, corporate responsibility and sustainability and affiliated transaction committees) and Pioneer Natural Resources Company (audit and nominating and corporate governance committees), as well as on the boards of trustees for the University of Louisville, the Gheens Foundation and the American Printing House for the Blind. From 2001 to 2011 Ms. Wood was a member of the board of trustees for Smith College.College, and a trustee of the University of Louisville from 2009 to 2015. Ms. Wood received her A.B. degree from Smith College and her M.B.A. from University of California Los Angeles. SkillsBoard committees

Audit (chairperson), Compensation and ExpertiseNomination and Corporate Governance | | | PhoebeDirector qualifications:

|

| | | | n | | Executive leadership: Ms. Wood has extensive experience as both a director and a member of senior financial management of public companies in a variety of industries. Her | | n | | Financial and accounting expertise: Ms. Wood has significant accounting, financial and business expertise, have mademaking her a particularly valuable addition to our directors’ mix of skills, and she has been designated as one of our audit committee’s financial experts, as defined under rules of the Securities and Exchange Commission.Commission (“SEC”). | | n | | Public company board experience: Ms. Wood serves on the following boards: Leggett & Platt, Incorporated (chair of compensation committee), Coca-Cola Enterprises Inc. (audit, corporate responsibility and sustainability, and affiliated transaction committees) and Pioneer Natural Resources Company (audit and nominating and corporate governance committees). |

| | | | | Retiring Directors continuing in office - Term expiring in 2017

|

Non-ExecutiveDenis Kessler

Non-Executive Director Age 64 Director since 2001 Committees:

Compensation,

and Nomination

and Corporate

Governance2002

| | Rex Adams (73) became chairman of the company in April 2006. HeDenis Kessler

Denis Kessler has served as a non-executive director of our company since November 2001March 2002. Mr. Kessler is chairman and aschief executive officer of SCOR SE. Prior to joining SCOR, Mr. Kessler was chairman of the French Insurance Federation, senior executive vice president of the AXA Group and executive vice chairman of the French Business Confederation. Mr. Kessler is a graduate from École des Hautes Études Commerciales (HEC Paris). He holds a Doctorat d’Etat from the University of Paris and Doctor Honoris Causa from the Moscow Academy of Finance and the University of Montreal. In addition, he is a qualified actuary. Mr. Kessler previously served as a member of the supervisory board of Yam Invest N.V. from 2008 until 2014, a privately-held company, and currently serves as a global counsellor of The Conference Board. Board committees Audit, Compensation and Nomination and Corporate Governance Committee | | | Director qualifications: |

| | | | n | | Public company CEO, relevant industry experience: Mr. Kessler’s experience as an economist and chief executive of a major global reinsurance company have combined to give him valuable insight into both the investment management industry’s macro-economic positioning over the long term as well as our company’s particular challenges within that industry. | | n | | Global business experience: Mr. Kessler’s experience as a director of a variety of international public companies in several industries enables him to provide effective counsel to our Board on many issues of concern to our management. | | n | | Public company board experience: Mr. Kessler currently serves on the boards of SCOR SE and BNP Paribas SA. He previously served on the boards of directors of Bollore from 1999 until 2013, Fonds Strategique d’Investissement from 2008 until 2013 and Dassault Aviation from 2003 until 2014. |

| | |

G. Richard Wagoner, Jr. Non-Executive Director Age 63 Director since January 2007.2013 | | G. Richard Wagoner, Jr. G. Richard (“Rick”) Wagoner, Jr. has served as a non-executive director of our company since October 2013. Mr. AdamsWagoner served as chairman and chief executive officer of General Motors Corporation (“GM”) from May 2003 through March 2009, and had been president and chief executive officer since June 2000. Prior positions held at GM during his 32-year career with that company include president and chief operating officer, executive vice president and president of North American operations, executive vice president, chief financial officer and head of worldwide purchasing, and president and managing director of General Motors do Brasil. On June 1, 2009, GM and its affiliates filed voluntary petitions in the United States Bankruptcy Court for the Southern District of New York, seeking relief under Chapter 11 of the U.S. Bankruptcy Code. Mr. Wagoner was deannot an executive officer or director of GM at the time of that filing. Mr. Wagoner is a member of the board of directors of Graham Holdings Company and several privately-held companies. In addition, he advises private equity firms, an investment bank and a number of start-up and early-stage ventures. Mr. Wagoner is a member of the board of visitors of Virginia Commonwealth University, chair of the Duke Kunshan University Advisory Board and a member of Duke University’s Fuqua School of Business at Duke University from 1996 to 2001 followingAdvisory Board. He is a 30-year career with Mobil Corporation. He joined Mobil International in London in 1965 and served as vice president of administration for Mobil Corporation from 1988 to 1996. Mr. Adams was previously a director and member of the audit committee at Vintage Petroleum.mayor of Shanghai, China’s International Business Leaders Advisory Council. Mr. Adams earned aWagoner received his B.A. from Duke University and his M.B.A. from Harvard University. Board committees Audit, Compensation and Nomination and Corporate Governance |

| | | Director qualifications: | n | | Former public company CEO, global business experience: Mr. Wagoner brings to the Board valuable business, leadership and management insights into driving strategic direction and international operations gained from his 32-year career with GM. | | n | | Financial and accounting expertise: Mr. Wagoner also brings significant experience in public company financial reporting and corporate governance matters gained through his service with other public companies. He was selectedhas been designated as a Rhodes Scholar in 1962 and studied at Merton College, Oxford University.one of our audit committee’s financial experts, as defined under rules of the SEC. | | n | | Public company board experience: Mr. AdamsWagoner currently serves on the Board of DirectorsGraham Holdings Company. |

| | | | | Director independence | | | For a director to be considered independent, the Board must affirmatively determine that the director does not have any material relationship with the company either directly or as a partner, shareholder or officer of Alleghany Corporationan organization that has a relationship with the company. Such determinations are made and formerly served as chairmandisclosed according to applicable rules established by the New York Stock Exchange (“NYSE”) or other applicable rules. In accordance with the rules of the Public Broadcasting Service.Skills and Expertise

Rex Adams has broad international experience in senior management of one ofNYSE, the world’s largest public companies, as well as substantial insight on a variety of business management issues from an academic perspective. His nearly decade of service on our Board has given himaffirmatively determined that it is currently composed of a deep understandingmajority of independent directors, and that the variety of issues encountered by investment management companies throughoutfollowing current directors are independent and do not have a material relationship with the business cycle.

company: Joseph R. Canion, C. Robert Henrikson, Ben F. Johnson III, Denis Kessler, Edward P. Lawrence, Sir Nigel Sheinwald, G. Richard Wagoner, Jr. and Phoebe A. Wood. |

| | |

Non-Executive

Director

Director since 1999

Committees:

Audit,

Compensation,

and Nomination

and Corporate

Governance

| | Sir John Banham (73) has served as a non-executive director

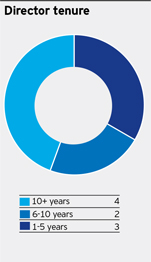

Director tenure The tenure of our directors ranges from one to over eighteen years, and they contribute a wide range of knowledge, skills and experience as illustrated in their individual biographies. We believe the tenure of the members of our Board of Directors provides the appropriate balance of expertise, experience, continuity and perspective to our board to serve the best interests of our shareholders. We believe providing our Board with new perspectives and ideas is an important component to a well-functioning board. To that end, our Board has undergone a thoughtful and strategic evolution over the past six years with four new directors being added to the board, a new chairperson of the Board and new chairpersons of each of the Board’s standing committees. As the Board considers new director nominees, it takes into account a number of factors, including nominees that have skills that will match the needs of the company’s long-term global strategy and will bring diversity of thought, global perspective, experience and background to our Board. For more information on our director nomination process, seeInformation about our Board and its Committees – the Nomination and Corporate Governance Committee below. |

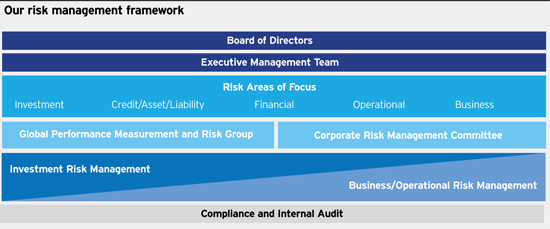

| | | | | Corporate Governance | | The Board has adopted Corporate Governance Guidelines. | | Corporate governance guidelines The Board has adopted Corporate Governance Guidelines (“Guidelines”) and Terms of Reference for our Chairperson and for our Chief Executive Officer, each of which is available in the corporate governance section of the company’s website at www.invesco.com (the “company’s website”). The Guidelines set forth the practices the Board follows with respect to, among other matters, the composition of the Board, director responsibilities, Board committees, director access to officers, employees and independent advisors, director compensation and performance evaluation of the Board. | The Board is elected by the shareholders to oversee our management team and to seek to assure that the long-term interests of the shareholders are being served. The company since 1999has chosen to separate the Chief Executive Officer and Board Chairperson positions. | | Board leadership structure As described in the Guidelines, the company’s business is conducted day-to-day by its officers, managers and employees, under the direction of the Chief Executive Officer and the oversight of the Board, to serve the interest of our clients and enhance the long-term value of the company for its shareholders. The Board is elected by the shareholders to oversee our management team and to seek to assure that the long-term interests of the shareholders are being served. In light of these differences in the fundamental roles of the Board and management, the company has chosen to separate the Chief Executive Officer and Board chairperson positions. The Board believes separation of these roles: (i) allows the Board more effectively to monitor and evaluate objectively the performance of the Chief Executive Officer, such that the Chief Executive Officer is more likely to be held accountable for his performance, (ii) allows the non-executive chairperson to control the Board’s agenda and information flow, and (iii) creates an atmosphere in which other directors are more likely to challenge the Chief Executive Officer and other members of our senior management team. For these reasons, the company believes that this board leadership structure is currently the most appropriate structure for the company. Nevertheless, the Board may reassess the appropriateness of the existing structure at any time, including following changes in board composition, in management or in the character of the company’s business and operations. | | Our Board has established a Code of Conduct and Directors’ Code of Conduct. | | Code of conduct and directors’ code of conduct As part of our ethics and compliance program, our Board has approved a code of ethics (the “Code of Conduct”) that applies to our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions, as chairmanwell as to our other officers and employees. The Code of Conduct is posted on the company’s website. In addition, we have adopted a separate Directors’ Code of Conduct that applies to all members of the Board. We intend to satisfy the disclosure requirement regarding any amendment to, or a waiver of, a provision of the Code of Conduct for our directors and executive officers by posting such information on the company’s website. The company maintains a compliance reporting line, where employees and individuals outside the company can anonymously submit a complaint or concern regarding compliance with applicable laws, rules or regulations, the Code of Conduct, as well as accounting, auditing, ethical or other concerns. | | | Board’s role in risk oversight The Board has principal responsibility for oversight of the company’s risk management processes and for understanding the overall risk profile of the company. Though Board committees routinely address specific risks and risk processes within their purview, the Board has not delegated primary risk oversight responsibility to a committee. | | | Our risk management framework provides the basis for consistent and meaningful risk dialogue up, down and across the company. Our Global Performance Measurement and Risk Group assesses core investment risks. Our Corporate Risk Management Committee assesses strategic, operational and all other business risks. A network of business unit, functional and geographic risk management committees under the auspices of the Corporate Risk Management Committee maintains an ongoing risk assessment process that provides a bottom-up |

| | | | | perspective on the specific risk areas existing in various domains of our business. Reflecting our efforts in this area, Standard & Poor’s Ratings Services has designated our enterprise risk management rating as “strong.” |

| | | | At each Board meeting, the Board reviews and discusses with senior management information pertaining to risk provided by the Global Performance Measurement and Risk Group and the Corporate Risk Management Committee. | |

|

| | | | | At each Board meeting, the Board reviews and discusses with senior management information pertaining to risk provided by the Global Performance Measurement and Risk Group and the Corporate Risk Management Committee. In these sessions senior management reviews and discusses with the Board the most significant risks facing the company. The Board has also reviewed and approved risk appetite guidelines. By receiving these regular reports, the Board maintains a practical understanding of the risk philosophy and risk appetite of the company. In addition, Board and committee agenda items on various topics regarding our business include discussion on risks inherent in our business. Through this regular and consistent risk communication, the Board has reasonable assurance that all material risks of the company are being addressed and that the company is propagating a risk-aware culture in which effective risk management is built into the fabric of the business. | | | In addition, the Compensation Committee since January 2007. Sir John was director general ofannually assesses the Confederation of British Industry from 1987 to 1992, a director of National Power and National Westminster Bank from 1992 to 1998, chairman of Tarmac PLC from 1994 to 2000, chairman of Kingfisher PLC from 1995 to 2001, chairman of Whitbread PLC from 2000 to 2005, chairman of Geest plc from 2002 to 2005 and chairman of Spacelabs Healthcare Inc. from 2005 to 2008. He was the chairman of Johnson Matthey plc from 2006 to 2011. He is currently chairman of Sultan Scientific Limited and of the UK Future Homes Commission, and an independent director of Cyclacel Pharmaceuticals Inc. Sir John is a graduate of Cambridge University and has been awarded honorary doctorates by four leading U.K. universities. Skills and Expertise

Sir John Banham brings to the Board a very broad appreciation for international business issues garnered over an extraordinary career in a variety of industries, including financial services. From 2006 to 2011 he was chairman of a successful global manufacturing company. As past director general of the Confederation of British Industry, he represented the views of British business to relevant governments and regulators. Sir John’s experience across a substantial spectrum of industries and companies within the United Kingdom gives him unique insight into the needsrisks of our business in onecompensation policies and practices for all employees. The Compensation Committee has concluded our policies and practices do not create risks that are reasonably likely to have a material adverse effect on the company. In reaching this conclusion, the Compensation Committee considered the input of Invesco’s most significant and successful markets.

|

For a director to be considered independent, the Board must affirmatively determine that the director does not have any material relationship with the company either directly or as a partner, shareholder or officer of an organization that has a relationship with the company. Such determinations are made and disclosed according to applicable rules established by the New York Stock Exchange (“NYSE”) or other rules. In accordance with the rules of the NYSE, the Board has affirmatively determined that it is currently composed of a majority of independent directors, and that the following directors are independent and do not have a material relationship with the company: Rex D. Adams, Sir John Banham, Joseph R. Canion, C. Robert Henrikson, Ben F. Johnson III, Denis Kessler, Edward P. Lawrence, J. Thomas Presby, G. Richard Wagoner, Jr. and Phoebe A. Wood.

Corporate Governance

Corporate Governance Guidelines. The Board has adopted Corporate Governance Guidelines (“Guidelines”) and Terms of Reference for our Chairman and for our Chief Executive Officer, each of which is available in the corporate governance section of the company’s Web site atwww.invesco.com(the “company’s Web site”). The Guidelines set forth the practices the Board follows with respect to, among other matters, the composition of the Board, director responsibilities, Board committees, director access to officers, employees and independent advisors, director compensation and performance evaluation of the Board.

Board Leadership Structure. As described in the Guidelines, the company’s business is conducted day-to-day by its officers, managers and employees, under the direction of the Chief Executive Officer and the oversight of the Board, to enhance the long-term value of the company for its shareholders. The Board is elected by the shareholders to oversee our management team and to assure that the long-term interests of the shareholders are being served. In light of these differences in the fundamental roles of the Board and management, the company has chosen to separate the Chief Executive Officer and Board chairman positions. The separation of these roles: (i) allows the Board to more effectively monitor and objectively evaluate the performance of the Chief Executive Officer, such that the Chief Executive Officer is more likely to be held accountable for his performance, (ii) allows the non-executive chairman to control the Board’s agenda and information flow, and (iii) creates an atmosphere in which other directors are more likely to challenge the Chief Executive Officer and other members of our senior management team. For these reasons, the company believes that this board leadership structure is currently the most appropriate structure for the company. Nevertheless, the Board may reassess the appropriateness of the existing structure at any time, including following changes in board composition, in management, or in the character of the company’s business and operations.

Code of Conduct and Directors Code of Conduct. As part of our ethics and compliance program, our Board has approved a code of ethics (the “Code of Conduct”) that applies to our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions, as well as to our other officers and employees. The Code of Conduct is posted on our company’s Web site. In addition, we have adopted a separate Directors’ Code of Conduct that applies to all members of the Board. We intend to satisfy the disclosure requirement regarding any amendment to, or a waiver of, a provision of the Code of Conduct for our directors and executive officers by posting such information on our Web site. The company maintains a compliance reporting line, where employees and individuals outside the company can anonymously submit a complaint or concern regarding compliance with applicable laws, rules or regulations, the Code of Conduct, as well as accounting, auditing, ethical or other concerns.

Board’s Role in Risk Oversight. The Board has principal responsibility for oversight of the company’s risk management processes and for understanding the overall risk profile of the company. Though Board committees routinely address specific risks and risk processes within their purview, the Board has not delegated primary risk oversight responsibility to a committee.

Our risk management framework provides the basis for consistent and meaningful risk dialogue up, down and across the company. Our Global Performance Measurement and Risk group assesses core investment risks. Our Corporate Risk Management Committee assesses strategic, operational and all other business risks. A network of business unit, functional and geographic risk management committees under the auspices of the Corporate Risk Management Committee maintains an ongoing risk assessment process that provides a bottom-up perspective on the specific risk areas existing in various domains of our business.

At each Board meeting, the Board reviews and discusses with senior management information pertaining to risk provided by the Global Performance Measurement and Risk group and the Corporate Risk Management Committee. In these sessions senior management reviews and discusses with the Board the most significant risks facing the company. The Board has also reviewed and approved risk tolerance

guidelines. By receiving these regular reports, the Board maintains a practical understanding of the risk philosophy and risk tolerance of the company. Through this regular and consistent risk communication, the Board has reasonable assurance that all material risks of the company are being addressed and that the company is propagating a risk-aware culture in which effective risk management is built into the fabric of the business.

The Compensation Committee has evaluated our compensation policies and practices for all employees and has concluded that such policies and practices do not create risks that are reasonably likely to have a material adverse effect on the company. In reaching this conclusion, we undertook the following process to evaluate our compensation policies and practices:

| • | | A working group comprised of representatives from our human resources department and risk management departments was established to review the potential risks associated withother business executives that reviewed each of Invesco’s compensation plans. This group concluded that none of our compensation policies or practices were reasonably likely to have a material adverse effect on the company. | | | Invesco’s compensation programs are designed to reward success over the long-term, promote a longer term view of risk and practices. return in decision making and protect against incentives for inappropriate risk taking. Examples of risk mitigation in our compensation program design include: |

| | | n | | The group first createdCompensation Committee considers several performance metrics in establishing the company-wide annual incentive pool each year, so no one metric creates an undue reward that might encourage excessive risk taking. The Committee does not attempt to rank or assign relative weight to any factor, but instead applies its judgment in considering them in their entirety; | n | | Investment professional bonus plans generally have multi-year measurement periods, caps on earnings and discretionary components; | n | | Sales and commission plans generally contain multiple performance measures and discretionary elements; and | n | | Executives receive a frameworksubstantial portion of compensation in the form of long-term equity that vests over multi-year periods. Time-based awards vest ratably over a four-year period. With respect to performance-based equity awards, we are transitioning the performance period from a 1-year to a 3-year performance period. Such awards will be subject to 3-year cliff vesting upon completion of a short transition period. As in the past, the financial performance for the riskperformance-based equity awards must be certified by the Compensation Committee and the awards are subject to a clawback. Executives are also subject to our stock ownership policy. |

| | | | | The Audit Committee routinely receives reports from the control functions of finance, legal, compliance and internal audit. The Global Head of Internal Audit reports to the Chairperson of the Audit Committee. The Audit Committee oversees the internal audit function’s planning and resource allocation in a manner designed to ensure testing of controls and other internal audit activities are appropriately prioritized in a risk-based manner. The Audit Committee also seeks to assure that appropriate risk-based inputs from management and internal audit are communicated to the company’s independent public auditors. | | The Board annually reviews its own performance. | | Board’s annual performance evaluation As part of its annual performance evaluation of the Board and each of its committees, the Board engages an independent external advisor specializing in corporate governance to coordinate the Board’s self assessment that incorporated certain focus areas (e.g., performance measures, measurement period, etc.) that we had identified through internalby its members. The advisor performs one-on-one interviews with directors and external sources.prepares a report for the Board’s review. The advisor presents the report in person to the Board, and the Board discusses the evaluation to determine what action, if any, could further enhance the operations of the Board and its committees. In addition to confidential and private interviews of each director, beginning in 2016 interviews are also conducted with those members of senior management who attend Board meetings on a regular basis. | | Invesco recognizes our responsibility to help sustain a healthy, clean environment for future generations. | | Social responsibility As a global investment management organization, Invesco recognizes our responsibility to help sustain a healthy, clean environment for future generations. We are committed to continuous improvement in environmental management within our business. |

Members of the group then reviewed each of Invesco’s compensation plans (formulaic bonus payment plans for investment professionals, equity-based plans, and sales commission plans), applying the established framework. Each item was assessed and classified as “low risk potential,” “medium risk potential” or “high risk potential.” | | | n | | The Invesco Environmental Steering Committee, which includes senior managing directors of the firm, oversees and drives the firm’s global environmental policy. The committee monitors environmental impacts, gathers ideas and suggestions for improving our global environmental management, and approves initiatives that drive our regional management processes. | n | | Invesco has also made significant progress in reducing our impact on the environment at a number of our global locations. Our Atlanta, Dublin, Frankfurt, Henley, Houston, Hyderabad, London, New York, Prince Edward Island and Toronto locations, which comprise approximately 83% of Invesco’s employees around the world, are ISO 14001 registered. This internationally recognized standard is a world-class environmental management system that certifies Invesco has the framework in place to effectively manage our environmental responsibilities. | n | | Invesco has received certification in the Leadership in Energy and Environmental Design (LEED) program. Our Hyderabad office achieved the highest platinum standard, while our New York office achieved the gold standard and our Atlanta headquarters and Houston office achieved the silver standard. LEED certification is globally recognized as the premier mark of achievement in green building, with LEED-certified buildings using resources more efficiently when compared with conventional buildings. | n | | Our company is a constituent of the FTSE4Good Index Series, which seeks to help investors identify organizations with good track records of corporate social responsibility. | n | | Invesco participates in the Carbon Disclosure Project, reporting on carbon emissions and reduction management processes, and our commitment to sound environmental practices is summarized in our Environmental Management Policy found on the company’s website. |

After reviewing each item and the cumulative assessment for each plan, the working group reported to Invesco’s Compensation Committee its findings that none of our compensation policies or practices were reasonably likely to have a material adverse effect on the Company.

The Compensation Committee reviewed these findings and concluded that none of Invesco’s compensation policies or practices were reasonably likely to have a material adverse effect on the Company.

The Audit Committee routinely receives reports from the control functions of finance, legal and compliance and internal audit. The Head of Internal Audit reports to the Chairman of the Audit Committee. The Audit Committee oversees the internal audit function’s planning and resource allocation in a manner designed to ensure testing of controls and other Internal Audit activities are appropriately prioritized in a risk-based manner. The Audit Committee also seeks to assure that appropriate risk-based inputs from management and internal audit are communicated to the company’s independent public auditors.

Information about the Board and | | | | | Information About the Board and Its Committees | | | Board meetings and annual general meeting of shareholders During the calendar year ended December 31, 2015, the Board held 13 meetings (not including committee meetings). Each director attended at least seventy-five percent (75%) of the aggregate of the total number of meetings held by the Board and the total number of meetings held by all committees of the Board on which he or she served during 2015. The Board does not have a formal policy regarding Board member attendance at shareholder meetings. Six of our nine directors then in office attended the 2015 Annual General Meeting. Those not attending the meeting were unable to be present due to travel schedules. The non-executive directors (those directors who are not officers or employees of the company and who are classified as independent directors under applicable NYSE standards) meet in executive session generally at each of the Board’s five in-person meetings each year and at least once per year during a regularly scheduled Board meeting without management. Ben F. Johnson III, our chairperson and a non-executive and independent director, presides at the executive sessions of the non-executive directors. | | | Committee membership and meetings Board Meetings and Annual General Meeting of Shareholders

During the calendar year ended December 31, 2013, the Board held ten meetings (not including committee meetings). Each director attended at least seventy-five percent (75%) of the aggregate of the total number of meetings held by the Board and the total number of meetings held by all committees of the Board on which he or she served during 2013. The Board does not have a formal policy regarding Board member attendance at shareholder meetings. Eight of our ten directors then in office attended the 2013 Annual General Meeting. Those not attending the meeting were unable to be present due to travel schedules. The non-executive directors (those directors who are not officers or employees of the company) meet in executive session at least once per year during a regularly scheduled Board meeting without management. Rex D. Adams, a non-executive and independent director, presides at the executive sessions of the non-executive directors. As previously announced, the Board has elected Ben F. Johnson III to serve as Chairman of the Board following the expiration of the term of Mr. Adams at the conclusion of this year’s Annual General Meeting.

Committee Membership and Meetings

The current committees of the Board are the Audit Committee, the Compensation Committee and the Nomination and Corporate Governance Committee. The table below provides current membership information. |

| | | | | | | | | | | | | | | Committee membership M – Member Ch – Chairperson | | | Name | | Audit | | | Compensation | | | Nomination and

corporate governance | | | | | | | | | | | | | | | Joseph R. Canion | | | – | | | | – | | | | Ch | | | | | | | | | | | | | | | Martin L. Flanagan | | | – | | | | – | | | | – | | | | | | | | | | | | | | | C. Robert Henrikson | | | M | | | | Ch | | | | M | | | | | | | | | | | | | | | Ben F. Johnson III | | | M | | | | M | | | | M | | | | | | | | | | | | | | | Denis Kessler | | | M | | | | M | | | | M | | | | | | | | | | | | | | | Edward P. Lawrence | | | M | | | | M | | | | M | | | | | | | | | | | | | | | Sir Nigel Sheinwald | | | M | | | | M | | | | M | | | | | | | | | | | | | | | G. Richard Wagoner, Jr. | | | M | | | | M | | | | M | | | | | | | | | | | | | | | Phoebe A. Wood | | | Ch | | | | M | | | | M | |

| | | | | Below is a description of each committee of the Board. The Board has affirmatively determined that each committee consists entirely of independent directors according to applicable NYSE rules and rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). | | | The Audit Committee The Audit Committee is chaired by Ms. Wood and consists additionally of Messrs. Henrikson, Johnson, Kessler, Lawrence, Sheinwald and Wagoner. The committee met 10 times during 2015. (The frequency of the committee’s meetings is due to its practice of separately considering certain matters, such as pre-filing review of quarterly reports, among others.) Under its charter, the committee: |

| | | Name | | Audit | | Compensationn | | Nominationis comprised of at least three members of the Board, each of whom is “independent” of the company under the NYSE and rules of the SEC and is also “financially literate,” as defined under NYSE rules;

Corporate

Governance

| Rex D. Adams (1)n

| | — | | M | | Cmembers are appointed and removed by the Board; | Sir John Banham (1)n

| | Mis required to meet at least quarterly; |

| | C | | M | Joseph R. Canion(1)n

| | — | | — | | Mperiodically meets with the head of Internal Audit and the independent auditor in separate executive sessions without members of senior management present; | Martin L. Flanagann

| | — | | — | | —has the authority to retain independent advisors, at the company’s expense, whenever it deems appropriate to fulfill its duties; and | C. Robert Henrikson(1)n

| | Mreports to the Board regularly. |

| | | | | MThe committee’s charter is available on the company’s website. The charter sets forth the committee’s responsibilities, which include assisting the Board in fulfilling its responsibility to oversee the company’s financial reporting, auditing and internal control activities, including the integrity of the company’s financial statements and assisting the Board in overseeing the company’s legal and regulatory compliance. | | | MThe committee has adopted policies and procedures for pre-approving all audit and non-audit services provided by our independent auditors. The policy is designed to ensure that the auditor’s independence is not impaired. The policy provides that, before the company engages the independent auditor to render any service, the engagement must either be specifically approved by the Audit Committee or fall into one of the defined categories that have been pre-approved. (SeePre-Approval Process and Policy below.) | Ben F. Johnson III(2)

| | M | | M | | M | Denis Kessler

| | M | | M | | M | Edward P. Lawrence

| | M | | M | | M | J. Thomas Presby

| | C | | — | | M | G. Richard Wagoner, Jr.

| | M | | M | | M | Phoebe A. Wood

| | M | | M | | M |

M — MemberC — Chairman

(1) | Neither Mr. Adams nor Sir John Banham has been nominated for re-election at the 2014 Annual General Meeting because each has reached the mandatory retirement age. The Board has appointeddetermined that all committee members are financially literate under the NYSE listing standards. The Board has further determined that each of Ms. Wood and Mr. Canion to serveWagoner qualifies as Chairmanan “audit committee financial expert” (as defined under the SEC’s rules and regulations), that each has “accounting or related financial management expertise” and that each is “independent” of the company under SEC rules and the NYSE listing rules. | | | The Compensation Committee | | | The Compensation Committee is chaired by Mr. Henrikson and consists additionally of Messrs. Johnson, Kessler, Lawrence, Sheinwald, Wagoner and Ms. Wood. The committee met seven times during 2015. Under its charter, the committee: |

| | | | n | | is comprised of at least three members of the Board, each of whom is “independent” of the company under the NYSE and SEC rules; | | n | | members are appointed and removed by the Board; | | n | | is required to meet at least four times annually; and | | n | | has the authority to retain independent advisors, at the company’s expense, whenever it deems appropriate to fulfill its duties, including any compensation consulting firm. |

| | | | | The committee’s charter is available on the company’s website. The charter sets forth the committee’s responsibilities, which include annually approving the compensation structure for, and reviewing and approving the compensation of, senior officers and non-executive directors, and overseeing the annual process for evaluating senior officer performance, overseeing the administration of the company’s equity-based and other incentive compensation plans, and assisting the Board with executive succession planning. | | | Each year the committee engages a third-party compensation consultant to provide an analysis of, and counsel on, the company’s executive compensation program and practices. The nature and scope of the consultant’s assignment is set by the committee. The committee currently engages Johnson Associates, Inc. (“Johnson Associates”) as its third-party consultant for this review. The committee has considered various factors as required by NYSE rules as to whether the work of Johnson Associates with respect to executive and director compensation-related matters raised any conflict of interest. The committee has determined no conflict of interest was raised by the engagement of Johnson Associates. For a more detailed discussion of the determination of executive compensation and the role of the third-party compensation consultant, please seeExecutive Compensation – Compensation discussion and analysis – Role of the independent compensation consultant below. | | | In addition, the committee meets at least annually to review and determine the compensation of the company’s non-executive directors. No executive officer of the company is involved in recommending or determining non-executive director compensation levels. SeeDirector compensation below for a more detailed discussion of compensation paid to the company’s directors during 2015. |

| | | | | The Nomination and Corporate Governance Committee | | | The Nomination and Corporate Governance Committee is chaired by Mr. Canion and Mr.consists additionally of Messrs. Henrikson, Johnson, Kessler, Lawrence, Sheinwald, Wagoner and Ms. Wood. The committee met four times during 2015. Under its charter, the committee: |

| | | n | | is comprised of at least three members of the Board, each of whom is “independent” of the company under the NYSE and SEC rules; | n | | members are appointed and removed by the Board; | n | | is required to meet at least four times annually; and | n | | has the authority to retain independent advisors, at the company’s expense, whenever it deems appropriate to fulfill its duties. |

| | | | | The committee’s charter is available on the company’s website. The charter sets forth the committee’s responsibilities, which include establishing procedures for identifying and evaluating potential nominees for director and for recommending to the Board potential nominees for election and periodically reviewing and reassessing the adequacy of the Guidelines to determine whether any changes are appropriate and recommending any such changes to the Board for its approval. The candidates proposed for election in Proposal No. 1 of this Proxy Statement were unanimously recommended by the committee to the Board. | | | The committee believes there are certain minimum qualifications that each director nominee must satisfy in order to be suitable for a position on the Board, including that such nominee: |

| | | n | | be an individual of the highest integrity and have an inquiring mind, a willingness to ask hard questions and the ability to work well with others; | n | | be free of any conflict of interest that would violate any applicable law or regulation or interfere with the proper performance of the responsibilities of a director; | n | | be willing and able to devote sufficient time to the affairs of the company and be diligent in fulfilling the responsibilities of a director and Board committee member; and | n | | have the capacity and desire to represent the best interests of the shareholders as a whole. |

| | | | | In considering candidates for director nominee, the committee generally assembles all information regarding a candidate’s background and qualifications, evaluates a candidate’s mix of skills and qualifications and determines the contribution that the candidate could be expected to make to the overall functioning of the Board, giving due consideration to the Board’s balance of perspectives, backgrounds and experiences. While the committee routinely considers diversity as a part of its deliberations, it has no formal policy regarding diversity. With respect to current directors, the committee considers past participation in and contributions to the activities of the Board. The committee recommends director nominees to the Board based on its assessment of overall suitability to serve in accordance with the company’s policy regarding nominations and qualifications of directors. | | | The committee will consider candidates recommended for nomination to the Board by shareholders of the company. Shareholders may nominate candidates for election to the Board under Bermuda law and our Bye-Laws. The manner in which the committee evaluates candidates recommended by shareholders would be generally the same as any other candidate. However, the committee would also seek and consider information concerning any relationship between a shareholder recommending a candidate and the candidate to determine if the candidate can represent the interests of all of the shareholders. The committee would not evaluate a candidate recommended by a shareholder unless the shareholder’s proposal provides that the potential candidate has indicated a willingness to serve as Chairmana director, to comply with the expectations and requirements for Board service as publicly disclosed by the company and to provide all of the information necessary to conduct an evaluation. For further information regarding deadlines for shareholder proposals, seeImportant additional information – Shareholder proposals for the 2017 annual general meeting below. |

| | | | | | | | Director compensation | | | Directors who are Invesco employees do not receive compensation for their services as directors. Under the terms of its charter, the Compensation Committee annually reviews and determines the compensation paid to non-executive directors. In reviewing and determining non-executive director compensation, the committee considers, among other things, the following the expiration of the terms of Mr. Adamspolicies and Sir John Banham at the conclusion of this year’s Annual General Meeting.principles: |

(2) | The Board has appointed Mr. Johnson to serve as Chairman | | | n | | that compensation should fairly pay the non-executive directors for the work, time commitment and efforts required by directors of an organization of the company’s size and scope of business activities, including service on Board following the expirationcommittees; | | n | | that a component of the termcompensation should be designed to align the non-executive directors’ interests with the long-term interests of Mr. Adamsthe company’s shareholders; and | | n | | that non-executive directors’ independence may be compromised or impaired for Board or committee purposes if director compensation exceeds customary levels. |

| | | As a part of its annual review, the committee engaged Johnson Associates as a third-party consultant to report on comparable non-executive director compensation practices and levels. This report includes a review of director compensation at the conclusionsame peer companies the committee considers for executive compensation practices (seeCompensation Discussion and Analysis – Compensation Philosophy, Design, Process – Review of this year’s Annual General Meeting.peer compensation below). Following the review of current market practices for directors of peer public companies, the Compensation Committee determined in December 2014 that the compensation for non-executives directors would remain the same for 2015. The compensation for non-executive directors for 2015 was as follows, with each fee component paid in quarterly installments in arrears: |

Below is a description of each committee of the Board. The Board has affirmatively determined that each committee consists entirely of independent directors according to applicable NYSE rules and rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Audit Committee

The Audit Committee is chaired by Mr. Presby and consists additionally of Messrs. Banham, Henrikson, Johnson, Kessler, Lawrence, Wagoner and Ms. Wood. The committee met twelve times during 2013. (The frequency of the committee’s meetings is due to its practice of separately considering certain matters, such as pre-filing review of quarterly reports, among others, in order to devote ample time for discussion and consideration.) Under its charter, the committee:

is comprised of at least three members of the Board, each of whom is “independent” of the company under the NYSE and rules of the Securities and Exchange Commission (“SEC”) and is also “financially literate,” as defined under NYSE rules;

members are appointed and removed by the Board;

is required to meet at least quarterly;

periodically meets with the head of Internal Audit and the independent auditor in separate executive sessions without members of senior management present;

has the authority to retain independent advisors, at the company’s expense, wherever it deems appropriate to fulfill its duties; and

reports to the Board regularly.

The committee’s charter is available on the company’s Web site. The charter sets forth the committee’s responsibilities, which include, among other items, assisting the Board in fulfilling its responsibility to oversee the company’s financial reporting, auditing and internal control activities, including the integrity of the company’s financial statements and assisting the Board in overseeing the company’s legal and regulatory compliance.

The committee has adopted policies and procedures for pre-approving all audit and non-audit services provided by our independent auditors. The policy is designed to ensure that the auditor’s independence is not impaired. The policy provides that, before the company engages the independent auditor to render any service, the engagement must either be specifically approved by the Audit Committee or fall into one of the defined categories that have been pre-approved. (See “Pre-Approval Process and Policy” below.)

The Board has determined that all committee members are financially literate under the NYSE listing standards. The Board has further determined that each of Mr. Presby and Ms. Wood qualifies as an “audit committee financial expert” (as defined under the SEC’s rules and regulations), that each has “accounting or related financial management expertise” and that each is “independent” of the company under SEC rules and the NYSE listing rules. The Board has also determined that Mr. Presby’s service on the audit committees of more than three public companies does not impair his ability to effectively serve on the Audit Committee.

The Compensation Committee

The Compensation Committee is chaired by Sir John Banham and consists additionally of Messrs. Adams, Henrikson, Johnson, Kessler, Lawrence, Wagoner and Ms. Wood. The committee met six times during 2013. As previously discussed, Mr. Henrikson has been appointed as chairman of the committee effective upon the close of the 2014 Annual General Meeting. Under its charter, the committee:

is comprised of at least three members of the Board, each of whom is “independent” of the company under the NYSE and SEC rules;

members are appointed and removed by the Board;

is required to meet at least four times annually; and

has the authority to retain independent advisors, at the company’s expense, wherever it deems appropriate to fulfill its duties, including any compensation consulting firm.

The committee’s charter is available on the company’s Web site. The charter sets forth the committee’s responsibilities, which include, among other items, annually approving the compensation structure for, and reviewing and approving the compensation of, senior officers and non-executive directors, and overseeing the annual process for evaluating senior officer performance, overseeing the administration of the company’s equity-based and other incentive compensation plans, and assisting the Board with executive succession planning.